The US-China tech rivalry has reshaped the global electronics sector, with both countries competing for technological dominance. This article explores the long-term implications of this competition, focusing on trade disruptions, innovation, and future industry trends.

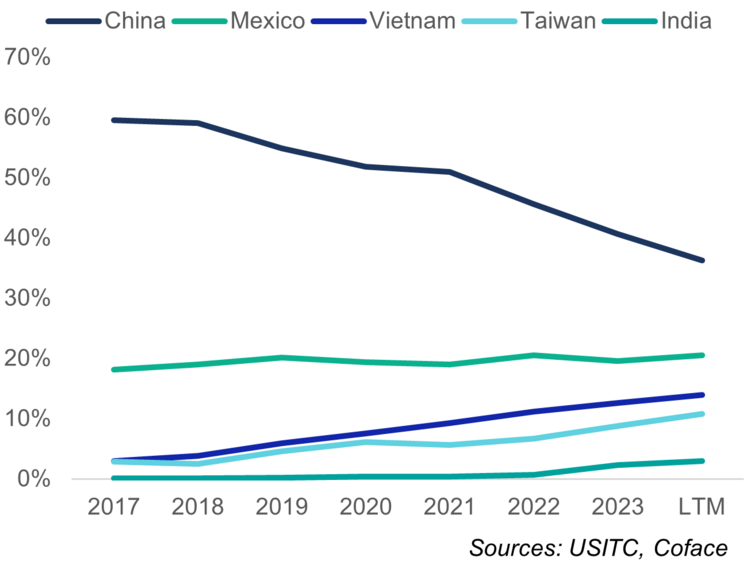

The US-China tech war has intensified dramatically since 2017, employing a full spectrum of measures from tariffs and export controls to restrictions on market access in a race for technological dominance that is reshaping the global electronics landscape. While our calculations indicate a substantial shift in US imports away from China that has cost the latter close to USD150 billion in lost exports since 2017 (Chart 1), they also suggest that underlying, mutual interdependence remains deeply rooted in the very structure of the industry: 29% of US semiconductor manufacturing machinery exports flow to China, and US electronics imports from Mexico, Taiwan and Vietnam incorporate a great deal of Chinese value-added.

US imports of electronic devices by country of origin (%)

Data for the graphs in .xls format

Resilience of US-China Electronics Ties

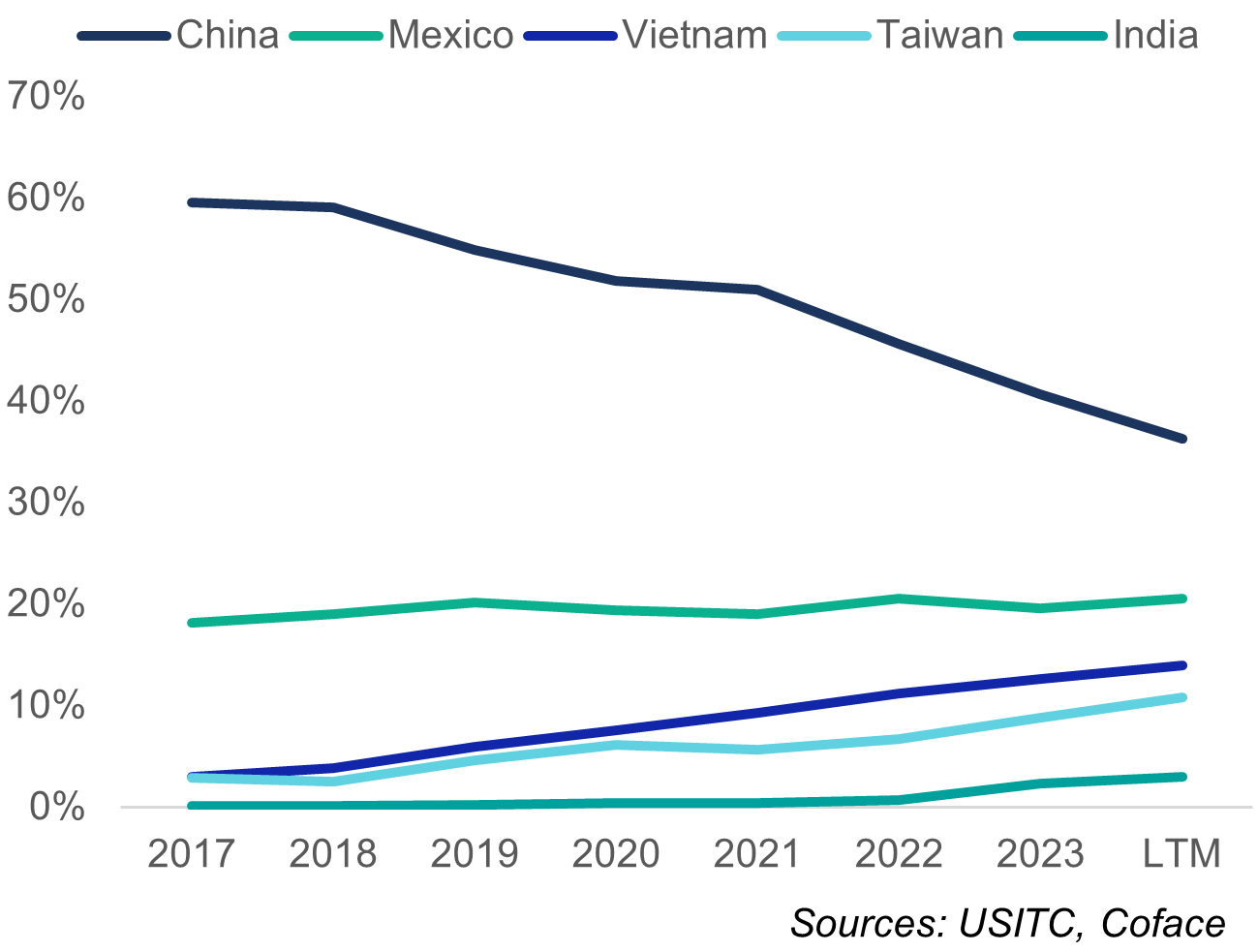

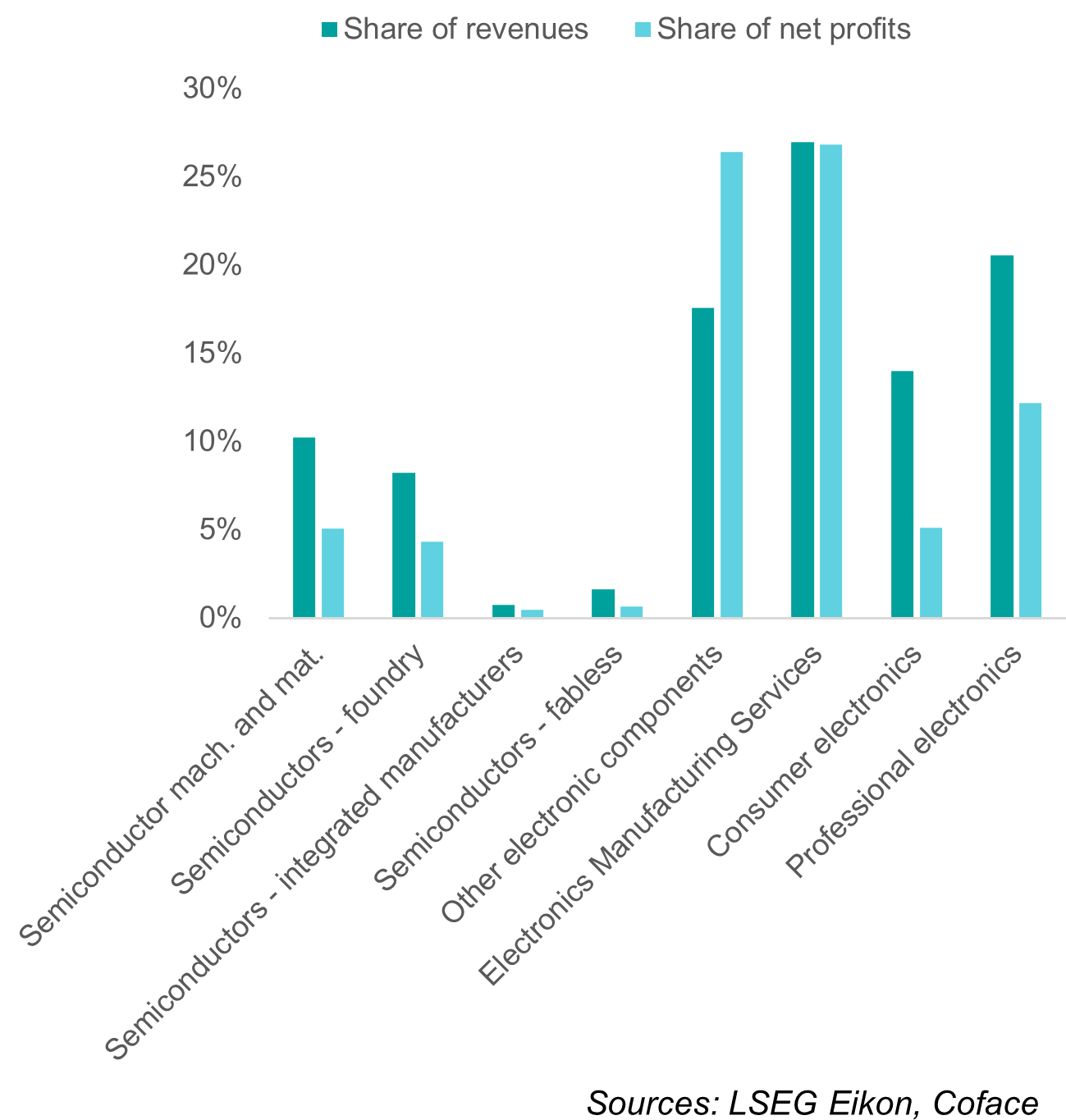

If the ties connecting the US and Chinese electronics industries have proven more resilient than what headline bilateral trade figures might suggest, it is largely because the US administration’s long-term drive to cut ties with China contradicts the short-term interests of corporate America and the world’s most dominant electronics companies. We estimate that over the last decade US companies alone accounted for 54% of global electronics profits, a share that balloons to 88% when including their Japanese, South Korean, and Taiwanese peers (Chart 2).

Meanwhile, despite surging sales and remarkable technological progress, Chinese companies only secured 7% of global industry profits and are still lagging far behind leaders in the all-strategic semiconductor segment (Chart 3). A major supplier of critical inputs, an unmatched manufacturing hub and one of the world’s largest consumer markets for electronics, China resembles more a condition for, rather than a threat to, the profitability of dominant US electronics companies.

Share of listed electronics companies in sales and profits by headquarter location in 2014-2023 (%)

Data for the graphs in .xls format

Share of listed Chinese companies in global sales and profits by segment, 2014-2023 average (%)

Data for the graphs in .xls format

However, the assumption that current patterns are going to continue during the coming years is at complete odds with the deep resolve of the US and China to maintain or acquire technological leadership and reduce dependencies, often by using trade as a weapon. Such a belief also discounts the possibility of a major industry shake-up triggered by radical innovation – a feature of the electronics industry. Home to more than 50% of global semiconductor production in the 1980s, Japan’s dominance was undermined by the rise of personal computing and the US’s strategic interventions to limit Japanese exports. Similarly, the smartphone revolution in the 2000s reshaped the industry, displacing leaders like Nokia and Motorola while elevating new players like Apple, Samsung, and TSMC. These shifts highlight the potential for unforeseen disruptions to redefine competitive dynamics and geographic leadership.

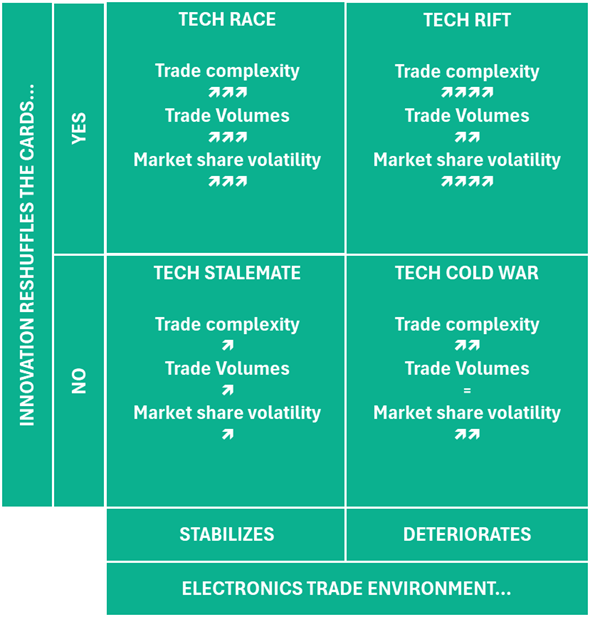

To explore how an acceleration in US-China rivalry and potential disruptive innovation might transform the industry value chain, we have identified the four scenarios: presented in Chart 4.

Changes in the innovation and trade environment and their possible outcomes over the next decade

Data for the graphs in .xls format

Future Scenarios: Tech Wars and Industry Disruptions

Depending on the scenario, the countries dominating the electronics industry will need to employ a mix of coping, adaptation and transformative strategies to keep their competitive edge in the intensifying tech race. Governments, particularly in the US and allied countries, are adopting strategic measures to bolster domestic capabilities, tie technology and trade alliances and reduce reliance on China. The US CHIPS and Science Act, which allocates USD 52 billion to semiconductor manufacturing and research, exemplifies such efforts. At the same time, China has accelerated its push for technological self-sufficiency, as evidenced by its doubling of semiconductor manufacturing machinery imports since 2017. These investments reflect both countries’ recognition of the strategic importance of electronics to national security and economic leadership. Emerging manufacturing hubs such as Vietnam and Mexico are well-positioned to benefit from trade fragmentation. For Europe, the challenges are particularly acute. The region lacks the centralized strategic momentum of the US and China and has yet to specialize in any specific part of the value chain. To maintain competitiveness, Europe must strengthen its innovation ecosystems, invest in strategic capabilities, and deepen cooperation with allied countries.

To assess the vulnerability to shocks of the various segments making up the electronics industry, we have developed a comprehensive risk scorecard measuring growth, innovation, profitability, capital intensity, leverage, etc. over a five-year period that captures a complete business cycle (2018-2023). Our analysis reveals that upstream segments like semiconductors and components were found to be structurally less vulnerable. These segments benefit from high profit margins, driven by value-added products and oligopolistic markets. However, their weaknesses include high capital intensity, which increases fixed costs, and long cash cycles, resulting from complex supply chains. Conversely, consumer and professional electronics segments scored higher in risk due to their exposure to competitive pressures, mature markets, and dependency on semiconductor companies with significant market power. These segments face moderate growth and are particularly impacted by competition from Chinese firms.

In this increasingly polarised landscape, electronics companies will have to navigate heightened risks of supply chain disruptions, foreign market access restrictions, geopolitical compliance pressures, standards divergence and investment constraints, all of which will play a part in exacerbating volatility in an already cyclical industry and adding a significant cost burden. Companies would be well-advised to pursue proactive supply chain diversification, devise contingency plans, empower regional subsidiaries with greater decision-making autonomy and flexibility, and reinforce risk management and compliance functions to enhance resilience and responsiveness within increasingly complex and localised trade environments.

> Want to know more on the Fragmented globalisation we are experiencing? <

Download our Guide on Global Trade